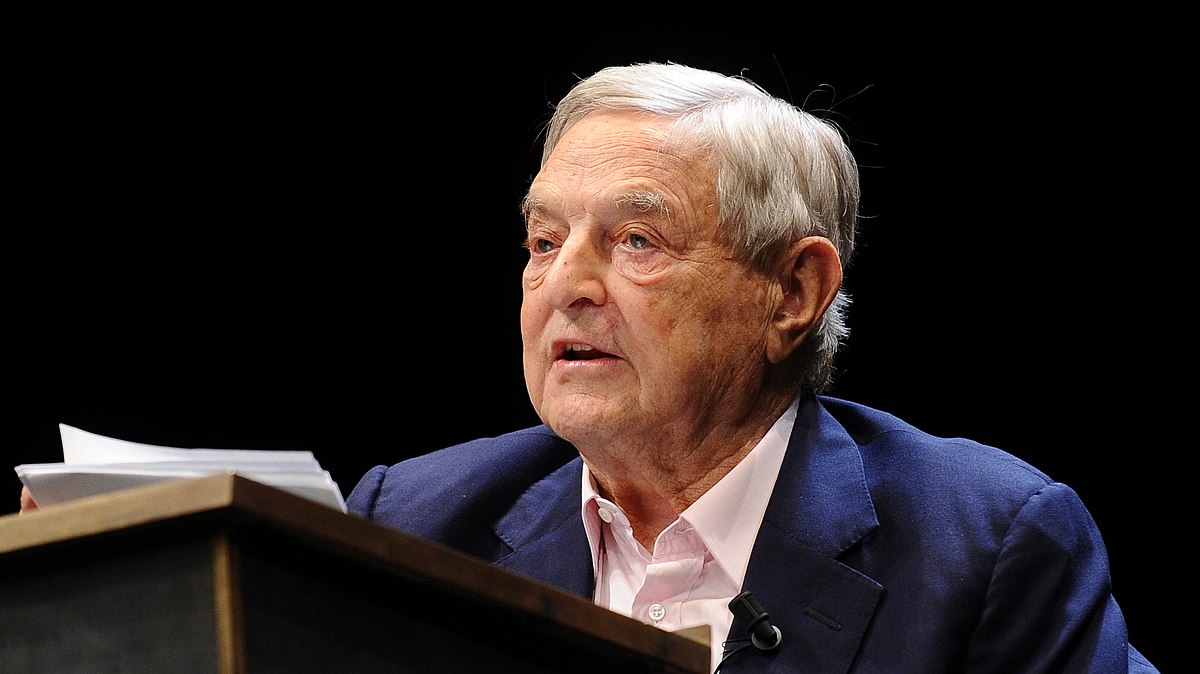

Billionaire George Soros has been blamed for some of the world’s ills and for some of the world’s good deeds. Whatever your opinion of the man, one thing now casts him back into the limelight. Like him or not, he is now preparing to launch his very own assault on the world of cryptocurrencies.

However, what does this mean for the rest of the world if Mr Soros is preparing his own charm offensive in the contested realm of ethereal gold?

Bloomberg has just reported that a family member of the Soros’ has been granted an internal approval to start trading cryptocurrencies. This comes as a highly unusual move from the realm of a person who is well up there with Warren Buffet in the world of finance.

Mr Buffet has been much more outspoken about the rather uncertain future of these assets, arguing that it will all finish rather badly for newcomers.

Soros Fund Management Head Adam Fisher has now received the approval to push ahead and attempt a major investment move in the crypto world.

It is a particular time to be entering the crypto world. Only a few months back, the value of Bitcoin, the world’s best recognised crypto currency, stood at $20,000 and it has recently tumbled down to $6,600. As far as any indicators go, cryptocurrencies are unstable to say the least.

The first three months of 2018, cryptocurrencies funds have decreased 52% of their net value, spelling a rather unpromising forecast for the future.

However, it is not only the overall uncertainty as to the precise value of all crypto assets. More factors need to be taken into account. The most recent onslaught against cryptocurrencies is definitely not to be sneezed at. The Reserve Bank of India (RBI) has taken its own onslaught against Bitcoin and any sort of cryptocurrencies, followed by Pakistan’s central financial body.

By another estimate, the US Internal Revenue Service (IRS) may in fact move on crypto owners who have accumulated $25 billion in unpaid taxes. This is quite the stoking figure that would send anyone veering off the cliff, no matter what their financial backing is.

In the case of Mr Soros, it is safe to assume that he will honour his taxes in a timely fashion. However, little is known about his future intention and what part of the market he will eventually hold.

With this in mind, as Bitcoin’s price is rather low right now, it does make sense for moneyed investors with plenty of disposable capital (albeit ‘plenty’ may be a gross understatement here) to enter the overall fray for cryptocurrencies.

With the course of Bitcoin and new promising tokens available at a reasonable price, it is a decent time to participate in cryptocurrencies. However, it may also be wiser to wait a bit, because of several factors.

- First, some doomsayers expect that Bitcoin will complete lose its value by the end of 2018;

- Others expect that central banks will start launching their own digital/crypto money that will eventually replace cash payments;

- Regulation is still very much being debated, and no international framework exists.

For someone to go into cryptocurrencies now, they must be prepared to lose a significant amount of money or have a great faith in the future of this particular token. Tokens as we know come and go.

QTUM is one of the newest and most promising alternatives that may be worth our attention. You will find yourself quite pleased to know that you can simply use the blockchain’s security and Ethereum’s smart protocols to change the future of crypto money and business at the same time.

With this in mind, investing profusely in Bitcoin may not be a wise call because the cryptocurrency may be difficult to obtain in the near future. As the calculations to dig up crypto Bitcoin become more complicate, the energy required to carry out a successful discovery of a new token significantly increase. In other words, you end up with so much energy consumption, that this energy could have been simply used to supply the needs of an entire country.

Some even expect Bitcoin to completely phase out of the market and ultimately succumb to the demise of time.

Of course, Mr Soros and his close ones are right to eye blockchain and crypto investments as a rule. Clever financiers, they stand to gain from subtle changes that they may have observed.

However, a fair warning goes to everyone dabbles in this realm. Without proper knowledge, and given the security risks still around, all investment should be taken with a pinch of salt.

Comments (No)