Abra the Wallet App that goes Kadabra!

A lot has changed in the world of cryptocurrencies. You will see yourself quite satisfied and quite pleased with everything that has served you. We encourage you to try to get the scoop of the latest changes that have transpired in the world of bitcoin and the fraternity of cryptocurrencies out there. In the latest move, one wallet, called Abra, has decided to expand overwhelming and make a decent splash in the pond of blockchain.

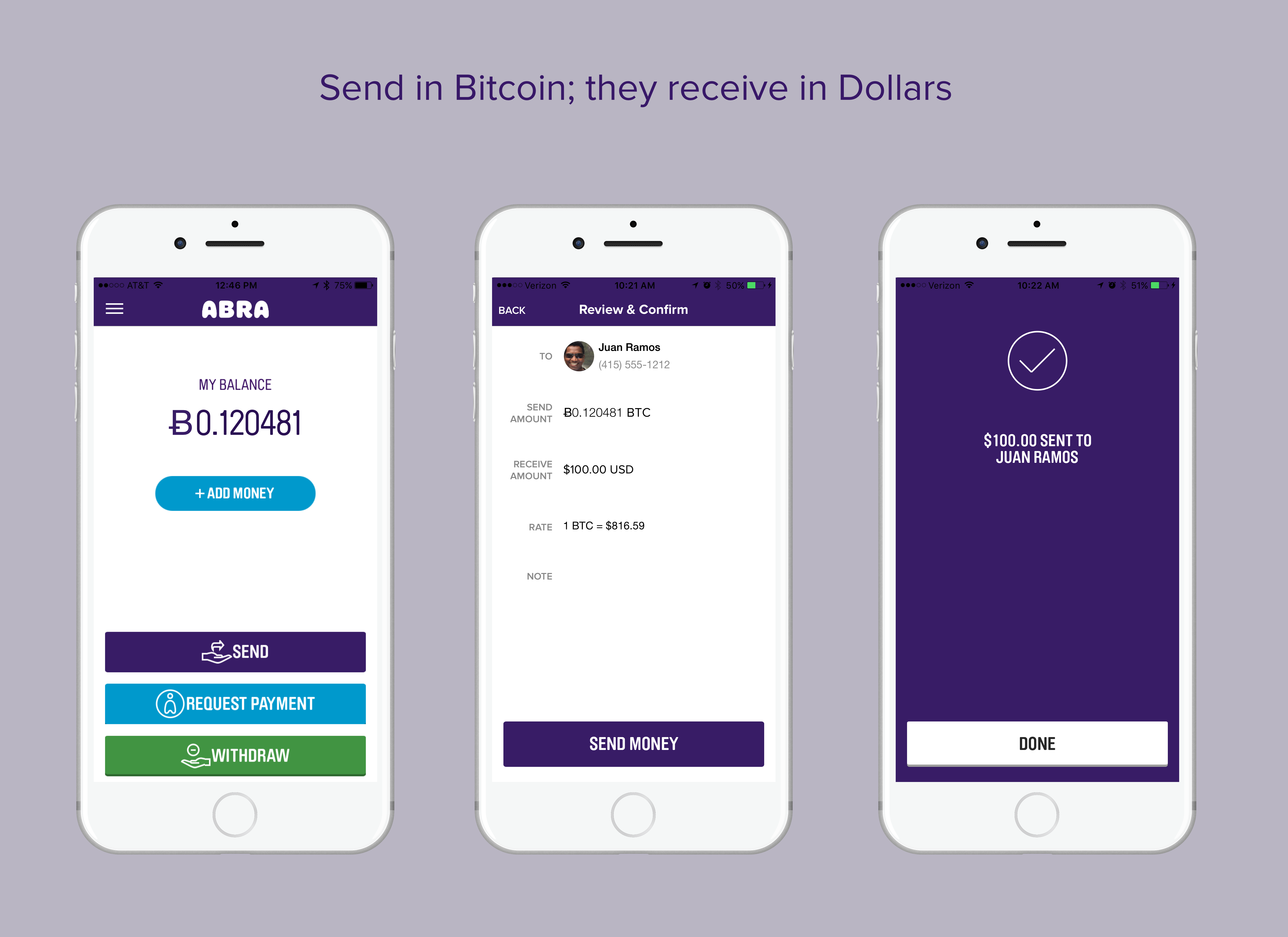

Crypto wallets are batty beasts. They often store a handful of currencies and allow transactions between one cryptocurrency into another. With this in mind, the latest round of announcements that Abra, the batty wallet home of many flagship chunks of digital gold, is making headlines most definitely.

Abra will now add 20 more cryptocurrencies. This is not all. Behold, as the wallet will also add 50 FIAT currencies to its offer, bridge nicely the gap between Bitcoin enthusiasm and the actual focal point where fiat money meets the digital counterpart. In its press release, the platform has been quite effusive:

Bitcoin, Ether, Litecoin, Ripple, Bitcoin Cash, Ethereum Classic, Dash, Zcash, Bitcoin Gold, Stellar Lumens, DigiByte, Dogecoin, Golem, OmiseGO, Qtum, Augur, Status, Stratis, Vertcoin and 0x are the initial 20 cryptocurrencies.

Abra developed a first-of-its kind smart contract investing platform that uses bitcoin technology to allow users to hold exposure to cryptocurrencies and fiat currencies on a smartphone much the same way Fidelity allows you to buy an ETF in the old world. […] With this model, we can enable exposure to any asset — Abra has only started with crypto and fiat.

The simple fact of the matter is that the system will allow you to convert into the cryptocurrencies that it has listed on its pages and that is quite brilliant when it comes to being able to control what is transpiring in the world of blockchain.

For the first time, people will have such a massive gateway to cryptocurrencies, swapping exchange and real currencies on a whim, which is quite the remarkable feat.

Consumers can add money to their wallets using a bank account, an American Express credit card in the United States or using bitcoin purchased outside Abra from anywhere in the world. They can then invest in any of the 20 cryptocurrencies offered on the Abra app, quickly, easily and safely. To develop the new wallet and integrated exchange, Abra built a first-of-its-kind platform using price-stabilized crypto tokens, called stablecoins, that facilitates holding both fiat coins as well as cryptocurrencies through a combination of litecoin and bitcoin based smart contracts. This unique multi-sig smart contract based investment platform uses Pay To Script Hash scripts on the litecoin and bitcoin blockchains that simulate investment contracts the way a gold ETF is a contract based on USD. Abra acts as the counter-party (i.e. the other signatory) to the P2SH scripts, enabling the company to now run a market making operation that hedges away its counter-party risk on these scripts.

Abra is also trying to do something completely different. By pegging cryptocurrencies closer to fiat money, the platform may actually achieve what everyone else has failed – establishing a reliable groundwork for cryptocurrencies so that they will no longer be as volatile as that.

Abra has been doing quite well in funding its own efforts. It concluded a capital increase fund that fetched it $40 million of fresh money, and many investors have deemed the investment worthy enough to participate in it, including Foxconn Technology, Group, silver 8 Capital, and many, many others.

In addition to the 50 fiat currencies, Abra previously supported Bitcoin and Etherium, but found that their users wanted the ability to invest in alternate cryptocurrencies in an easy and quick manner — without the hassle of multiple transactions and fees.

With the latest revolutionary announcement, Abra is quite well-poised to change the rules of the game for everyone, from crypto owner to trader. There is something else. If people start swapping their FIAT money for cryto money, it is likely that regulators will be able to garner a better insight in the inner workings of all who own those assets. It is also a way to better regulate any transactions that may appear suspicious.

Abra of course has not introduced this move to be able to compromise the anonymity of its customers. However, regulatory oversight is sorely needed and it would be a good idea to start with that on time instead of giving cryptocurrencies the time to develop into completely intraceable networks where everyone can hide their shady dealings.

Comments (No)