Welcome to our newest guide! Coincomparator is bringing you the latest round of tip on how to make our crypto investment matter. We have so far looked into a comprehensive list of all terms that you may ever need to navigate the murky waters of blockchain.

With our help, you will be always abreast of what is happening in the world of cryptocurrencies. Now, a little insight from the kitchen. On Friday, we will bring you a separate guide explaining what ICOs are and who stands to benefit from those! Stay tuned and in the meanwhile…

…Have you paid your cryptocurrency tax?

Yes, for many of us obtaining cryptocurrency has been the self-evident quest to limitless wealth. However, this trek, arduous as it is, may seem to be coming to an end as we are ever so subtly pushed into the limelight of the realities here.

The US tax system is a complicated beast. A beast with a large appetite nonetheless. If you have so far been notching up hefty profits from various places in cryptocurrency, Coinbase comes to mind and it is time to ultimately reconsider.

Yes, we are here to state the plain simple truth. If you have received the IRS-threshold of revenues, it may be time for you to take a closer look at how you should manage your funds further.

When should I declare my earnings?

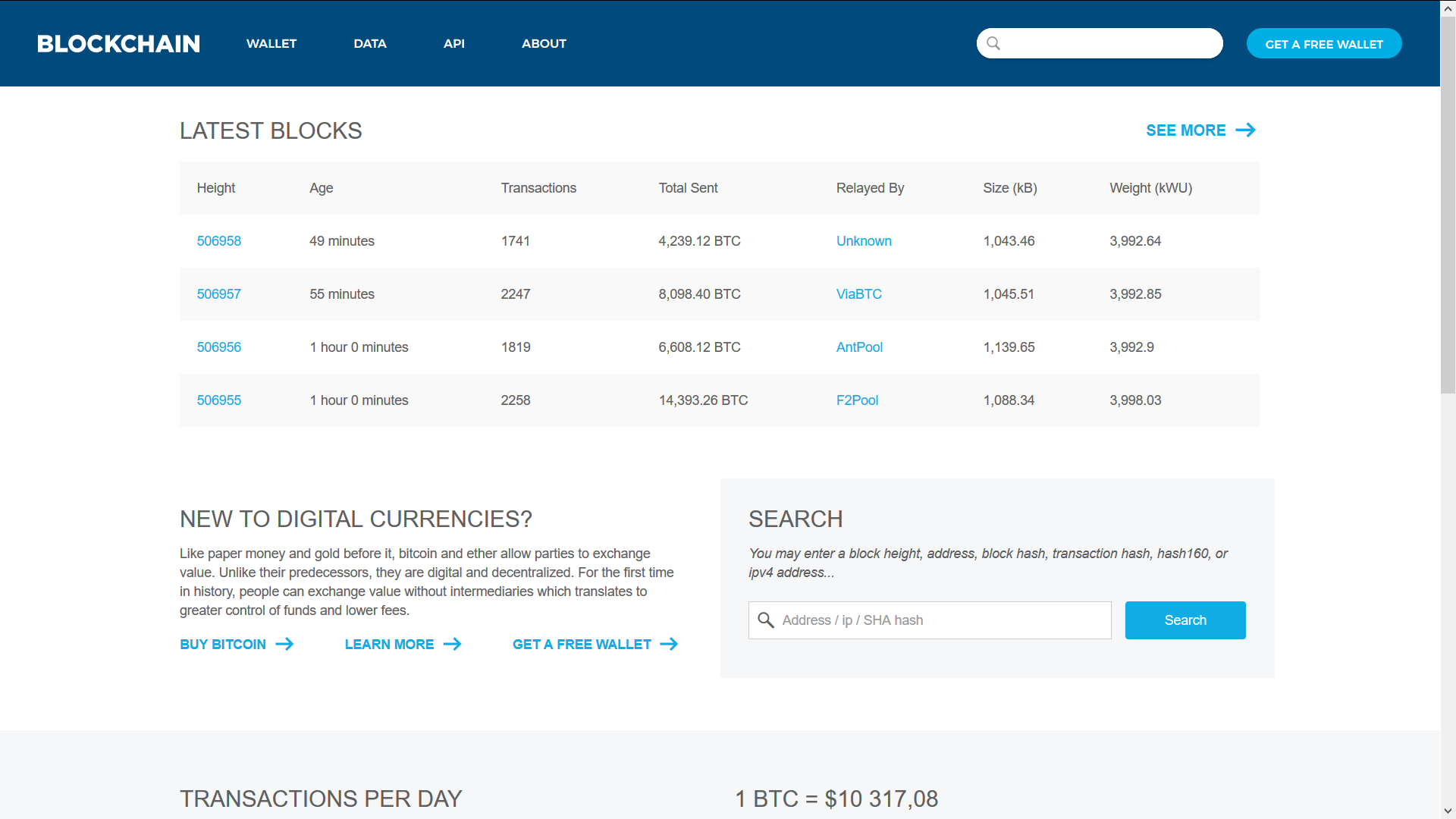

With Coinbase, a threshold has been established at $20,000. Any sum that equals or is beyond the $20,000-treshold will make you liable. Luckily the measure is only applicable in the United States. Other legislations have not yet hammered out a way to deal with how they should charge people who indulge in the crypto craze.

Is it fair?

Paying tax, in our modest opinion, is fair. And you should do it. Cryptocurrencies guarantee anonymity, but they should not be used as a way to introduce a host of illegal activities.

You must not shun responsibility, just because nobody is looking. Well, this is about to change. If you are a Coinbase user, however, you may be concerned as to how the IRS may find out that you have been using and receiving Bitcoin.

Well, your transactions may still be anonymous, but Coinbase tends to know its users and as a result you may second guess the much-touted security measures that such places put in place.

Still, we believe that everything about Coinbase is on point. Meeting regulatory measures instead of trying to avoid them or cover them up is a mature way to handle the situation.

On top of that, you may be appreciative that the place where you are exchanging digital golden chunks is in fact trying to play the long-term game. It means you may as well have a great winner.

What if I have been charged wrongly?

If you suspect Bitcoin has issued you a tax deductible wrongly, you should contact customer support. Take into consideration that Coinbase is so far the only exchange to actually use this taxation.

However, as regulatory measures become omnipresent, you may very soon see more exchanges charging customers who have a lot in the way of crypto assets. In fact, this may become a necessary entry-level for any new operator.

The future of taxing Bitcoin and the fraternity of cryptocurrencies is definitely thorny. Hold on to your wallets and mind the $20,000-threshold.

Taxation Ahead!

Coincomparator believes that everyone should pay their due. However, we are reserved one key note. Is taxation right now really necessary? To our mind, the constant breaches in the security of South Asian exchanges are far more disconcerting than who has paid their tax.

A lot remains to be done for a brighter future of cryptocurrencies. Rest assured that if any exchanges come under regulation, we will let you know in our news section.

Feb 06, 2018

Did You Pay Your Cryptocurrencies Taxes?

Comments (No)