A cohort of people have been pondering the question – should I follow in the footsteps of those who have succumbed to the Bitcoin craze? Is it worth the computing power, electricity bill and fried hardware? While mining Bitcoin is a matter of another article altogether, we have set out to explain how you can buy bits of digital gold in a couple of easy steps. In fact, you will now see that purchasing Bitcoin is no different from installing any other software available at the Google or Apple Store. Let us have a look.

Step 1: Purchasing your wallet

We have briefly discussed crypto wallets in our glossary. Think of a Bitcoin wallet as your bank account, only the currency you can have stored on it is Bitcoin. Interestingly enough, Bitcoin appeals to users of all stripes. In other words, you may purchase a standard wallet, one adapted for Android and yet another iteration specifically tailored for iOS users:

- info (Desktop users);

- Android Bitcoin Wallet (Android users)

- iOS Bitcoin Wallet (iOS users)

With any of the above-registered wallets, it would take you mere moments to complete registration. Some are more intuitive than others and they can tinker with regional settings, such as languages and time zones, adjusting your interface accordingly.

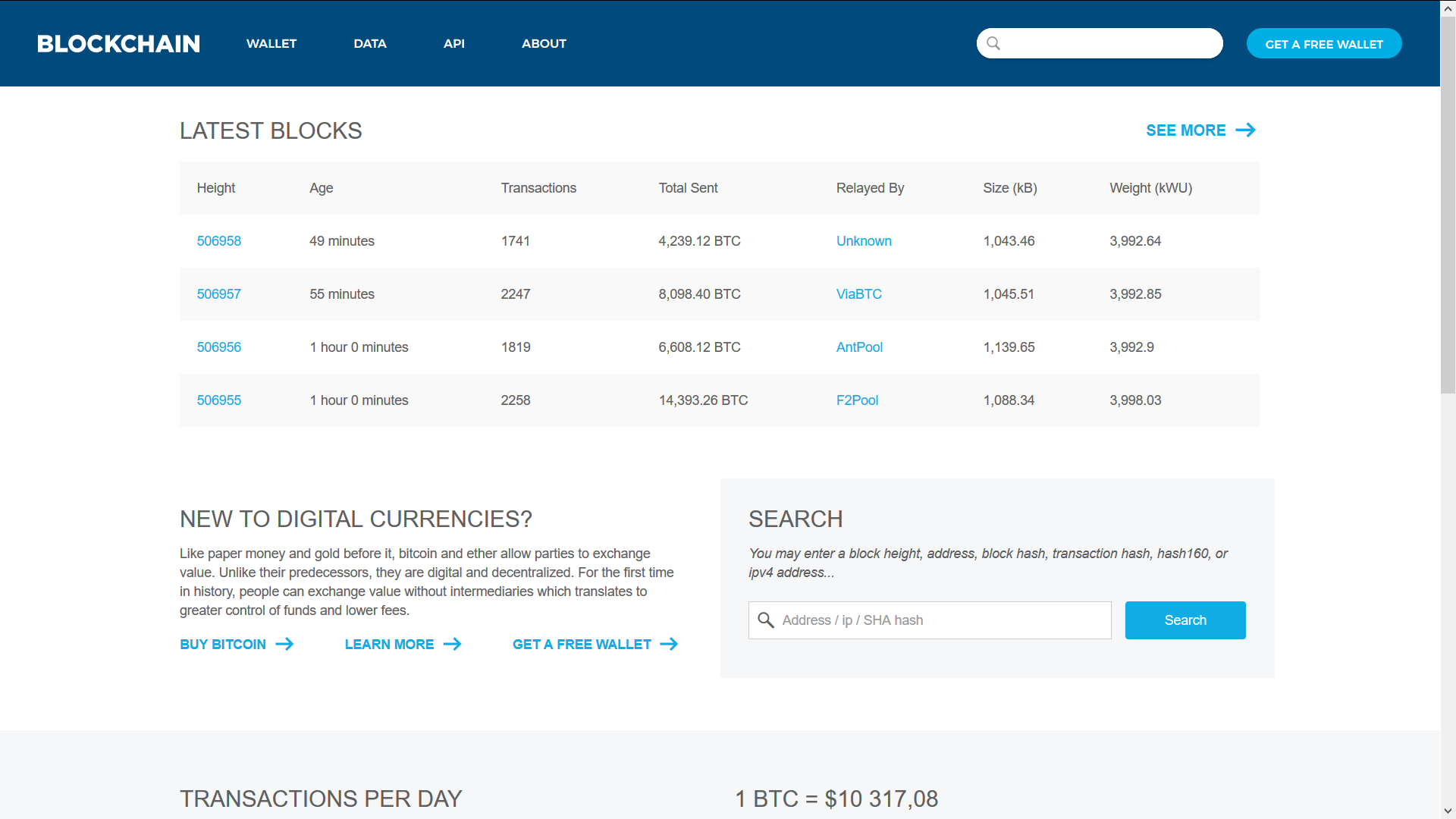

Beyond that the interface is quite appealing and also straightforward. It is similar to managing your money from your online banking account. In the case of Blockchain.info, you will be offered three main currencies to pick from.

It is worth noting that some wallets will focus exclusively on one single protocol (i.e. Bitcoin and Bitcoin Cash) whereas others will allow you to dabble into multiple currencies, which is not a bad thing altogether.

Step 2: Getting your money worth in Bitcoin

Now that you have registered your Bitcoin wallet, it is time to actually load it up with some much-coveted currency. At this point of Bitcoin’s movement, it is time for you to drop the idea of mining the currency yourself altogether. If you put together your own hardware to mine bitcoin yourself, you need to know that the chances are three things will happen:

- Your hardware will wear down and burn;

- You will pay more in electricity bill than you will make in Bitcoin;

- You will give up halfway through because of the difficult of the process;

Instead, the fastest, safest and most reliable way of investing into Bitcoin today is by exchanging FIAT currencies for the digital gold. To do so, simply choose a payment method, including credit card, bank transfer or debit card and go to a coin exchange. Alternatively, you can stick with your wallet, which also allows purchasing digital currencies. You may see the current course of Bitcoin here. For a full list of all cryptocurrencies’ value, check out our Coin Comparator.

Blockchain.info is an example of coin exchange-cum-wallet. It is true that exchanges may offer wallet services, however it is highly recommendable that you store your cryptocurrencies on a secure offline wallet. It is also known as cold storage and it is estimated to be the safest way for one to keep their Bitcoin and similar currencies on.

Meanwhile, a brief explanation of coin exchanges would be that you may use those places to trade and indeed exchange all sorts of assets, from regular FIAT ones to digital chunks of gold. The choice lies chiefly with you.

Where the Bitcoins dwell

A common misconception is that your Bitcoin are owned and stored in your crypto wallet. This is not entirely true. Bitcoin are a fixed amount available to the vast public through the public ledger. However, only owners who possess a string of code (comparable to an ATM’s PIN) may trade a certain part of that Bitcoin, or what is rightfully theirs.

A crypto wallet then goes to store your PIN, which authorizes transactions and allows you to exchange certain amounts of the currency you own. The safest way to secure your PIN or KEY is by using an offline storage device.

Remember that using multisig wallets are what we consider the best way of handling your investment. We will dwell on the matter in a separate guide.

Conclusion

Bitcoin is an exciting opportunity for fresh investors with plenty of disposable income. The main advantage of the cryptocurrency is that people are their own bankers and with this being said, they would hardly have to worry much about sacrificing their investment. As long as the crypto market is buoyant, so will your investment.

Comments (No)